Jan 27, 2026

by Nikhil Pai

Every disability attorney knows the 60-day appeal deadline. It's not obscure knowledge. The problem isn't knowing the rule; it's learning about the triggering event fast enough to act on it.

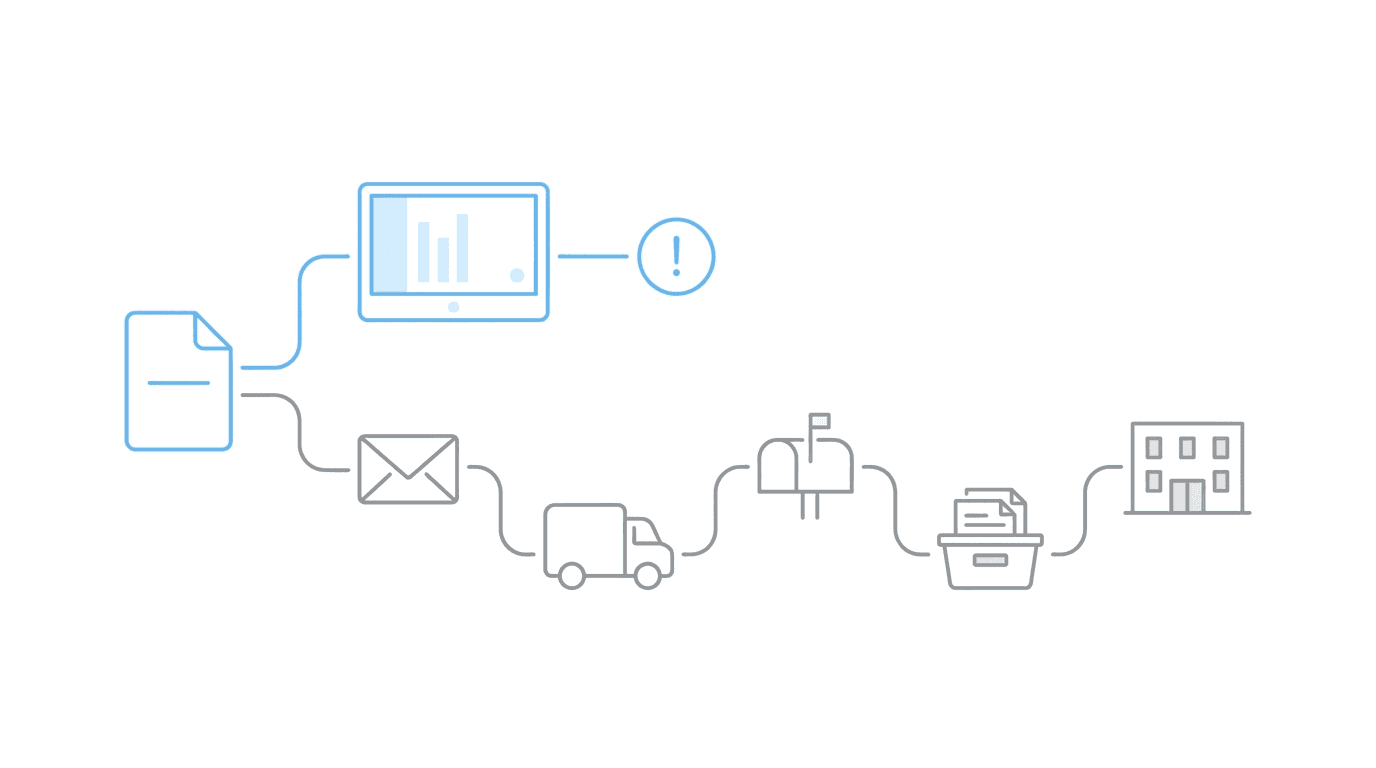

"We'd get a 10-day notice on day 9 or a 25-day letter on day 24. That made things a lot more challenging." Jonathan Heeps of Martin, Jones & Piemonte described a pattern most disability firms recognize. SSA sends a notice. USPS delivers it. By the time staff opens the envelope, scans the document, and routes it to the right person, the deadline has already compressed from 60 days to something far shorter.

This guide covers the SSA deadlines that matter for disability law firm operations: appeal windows, pre-hearing requirements, post-decision deadlines, and the systems that prevent misses.

The 60-Day Rule and Why It's Not the Real Problem

SSA gives claimants 60 days to appeal an unfavorable decision. This applies at every stage: initial denial, reconsideration, ALJ hearing, Appeals Council, and federal court. The clock starts when the claimant receives the notice.

Here's where it gets complicated. SSA presumes receipt five days after the notice date. A denial letter dated March 1 is presumed received by March 6. The 60-day window closes May 5. If your client actually received it March 10 due to mail delays, you can present evidence of later receipt. That requires documentation most claimants don't have.

For firms, the math is worse. The letter arrives at your office. Someone opens it. It gets scanned, uploaded to your case management system, assigned to a paralegal, calendared. Each step takes time. A 60-day deadline that started on March 6 might not surface on anyone's task list until March 20. Now you have 46 days.

The deadline itself is generous. The awareness gap is not.

Appeal Deadlines by Stage

Every appeal stage carries the same 60-day deadline, but the triggering events and required forms differ. Missing any of these forces the client to restart from the beginning or petition for a good cause extension.

Stage | Deadline | Triggered By | Form Required | Consequence of Miss |

|---|---|---|---|---|

Reconsideration | 60 days from receipt | Initial denial notice | SSA-561 | Must file new application |

ALJ Hearing | 60 days from receipt | Reconsideration denial | HA-501 | Must file new application |

Appeals Council | 60 days from receipt | ALJ unfavorable decision | HA-520 | Must file new application or request good cause |

Federal Court | 60 days from receipt | Appeals Council denial or own-motion review | Civil complaint | Claim ends unless good cause granted |

The consistency of the 60-day rule creates a false sense of simplicity. Each stage has different operational requirements. Reconsideration requests can be filed online. ALJ hearing requests require more detailed documentation. Appeals Council submissions often need legal briefs. Federal court filings demand civil procedure compliance.

A firm tracking 200 active cases has deadlines distributed across all four stages. The 60-day windows overlap and stack. Without systematic tracking, something slips.

Pre-Hearing Deadlines That Catch Firms Off Guard

The appeal deadlines get most of the attention. The pre-hearing operational deadlines cause just as many problems.

5 Business Days Before Hearing: Evidence Submission

SSA requires written evidence to be submitted at least five business days before the hearing date. Medical records, opinion letters, vocational evidence, any documentation the ALJ hasn't already seen. Miss this deadline and you need to explain at the hearing why the evidence is late. The ALJ may refuse to consider it.

Five business days sounds manageable until you realize the evidence needs to be in SSA's hands, not in transit. For a Monday hearing, the deadline is the prior Monday. A firm juggling multiple hearings per week, each with its own evidence package, faces real coordination challenges.

Scheduling Conflict Notifications

When SSA schedules a hearing, firms have a limited window to request changes. If the attorney has a conflict, if the claimant can't attend, if a critical witness is unavailable, the objection needs to be filed promptly. The specific timeframe depends on the hearing office. Delays reduce the likelihood of rescheduling.

Representative Appointment

If representation changes or a new representative joins the case, SSA needs form SSA-1696 before certain actions can be taken. This isn't a hard deadline in the same sense as appeals. Delays in representative appointment can slow evidence submission and hearing coordination.

Post-Decision Deadlines

After a decision issues, a different set of deadlines applies. These are easier to miss because they don't follow the same 60-day pattern.

10 Days: Benefit Continuation (Cessation Cases)

This is the deadline that causes the most damage when missed. If SSA determines a claimant is no longer disabled and terminates benefits, the claimant can request continued benefits during the appeal. The request must be filed within 10 days of receiving the cessation notice.

Ten days. Not 60. The same mail delay problem applies.

If the cessation notice arrives on day 8 and staff doesn't process it until day 11, the client loses benefits during what could be a multi-year appeal. Income, health insurance, stability gone while fighting to restore benefits they've relied on for years.

Overpayment Waiver Requests

When SSA determines it overpaid a claimant, the claimant can request waiver or reconsideration. These requests have deadlines that vary by situation. The pattern is consistent: the clock starts when SSA sends the notice, not when the firm becomes aware of it.

Reporting Requirements

Claimants receiving benefits have ongoing reporting obligations. Changes in income, living situation, medical condition, and work activity need to be reported within timeframes that vary by benefit type. Firms handling post-entitlement work need systems to track these requirements.

Good Cause Extensions: When SSA Grants More Time

Missing a deadline isn't always fatal. SSA can grant extensions for "good cause," but this requires explaining why the deadline was missed and demonstrating circumstances beyond the claimant's control.

Qualifying circumstances include:

Serious illness of the claimant or immediate family member

Death in the immediate family

Destruction of records (fire, flood, similar event)

Failure to receive notice from SSA

Misleading action by SSA

Inability to understand requirements due to mental or physical condition

Unusual or unavoidable circumstances preventing timely filing

"We were busy" doesn't qualify. "The mail was slow" is difficult to prove. "Our staff didn't calendar it" is the firm's problem, not good cause.

Extensions exist as a safety valve, not a planning strategy. The approval rate varies by ALJ and circumstance. Firms that rely on good cause requests to fix deadline misses will eventually have one denied.

Why Manual Deadline Tracking Fails

Small firms with a few dozen cases can track deadlines manually. Someone opens the mail, calculates the deadline, enters it in a calendar, assigns a task. The system works because the volume is manageable and the person doing it remembers the context.

Under 150 cases, the system strains. At 150-600, it starts failing. At 600+, it requires either significant staff overhead or systematic infrastructure.

The failure modes are predictable.

Physical mail sits in a stack. Staff is out sick. The person who usually opens mail is in a hearing. By the time the notice gets processed, days have passed. Or someone miscalculates the 60-day window and the deadline goes on the wrong date. Nobody catches it until after the deadline passes.

When something goes wrong, there's often no record of when the notice arrived, who processed it, or how the deadline was calculated. Reconstructing what happened requires memory and guesswork. Staff turnover makes this worse; the person who knew the deadline system leaves, and their replacement doesn't have the same context.

The bigger gap is timing. SSA posts documents to Electronic Records Express before mailing them. A firm relying on physical mail for deadline awareness is learning about notices days or weeks after the information was available electronically.

The pattern at Martin, Jones & Piemonte was common: 10-day notices arriving on day 9. That's not a deadline problem. That's an awareness problem. The deadline was always 10 days. The firm just didn't know about it until day 9.

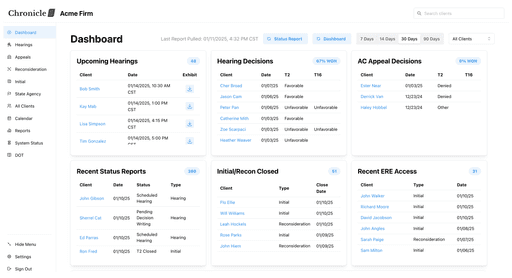

Chronicle provides real-time monitoring of SSA Electronic Records Express (ERE) activity. Chronicle alerts firms when new SSA correspondence or ERE documents are posted. The deadline doesn't change, but awareness does. A notice that would have arrived by mail on day 9 surfaces in Chronicle on day 1.

Chronicle includes deadline monitoring and alerts to reduce missed tasks in case prep. When a denial posts to ERE, the system flags it. Staff see it the same day. The full 60-day window is available for response.

Michele Marois of Anderson Marois & Associates described the operational shift: "We don't even have to wait for a denial letter. We can enter the date of the denial, download whatever denial document it is and get that appeal filed..."

The appeal gets filed before the physical mail arrives.

Frequently Asked Questions

What happens if we miss a 60-day appeal deadline?

The client typically must restart their claim from the initial application. This resets the protective filing date, potentially affecting benefit amounts and eligibility periods. You can petition for a good cause extension, but approval isn't guaranteed.

Does the 60-day deadline start when SSA sends the notice or when we receive it?

SSA presumes receipt five days after the notice date. The 60-day clock starts from that presumed receipt date unless you can prove actual receipt occurred later.

How strict is the 5-day evidence submission deadline before hearings?

ALJs have discretion. Late evidence may be accepted with explanation, but there's no guarantee. Submitting evidence on time avoids the issue entirely.

Can we get an extension for the 10-day benefit continuation deadline?

Extensions are rare for this deadline because of how cessation appeals work. Missing it means benefits stop during the appeal, which can take years to resolve.

How do firms track deadlines across hundreds of active cases?

Manual tracking fails at volume. Firms handling significant caseloads typically use case management systems with automated calendaring, ERE monitoring to catch notices early, or dedicated workflow infrastructure like Chronicle.

Moving Forward

SSA deadlines aren't complicated. The 60-day appeal window is consistent across stages. The 10-day benefit continuation rule is critical but straightforward. The 5-day evidence deadline is tight but known.

The complexity is operational. How does your firm learn about deadlines fast enough to act? How do you ensure nothing slips when volume increases or staff changes? What's the audit trail when something goes wrong?

Firms that treat deadline tracking as a calendaring problem will eventually have a miss. The solution isn't better calendars. It's earlier awareness.

Chronicle is built for Social Security disability practices; it focuses on SSA-facing operational workflows. ERE monitoring surfaces notices the day they post, not the day mail arrives. Deadline alerts ensure critical dates don't depend on manual calendaring.

The 60-day deadline is generous. The question is whether your firm uses all 60 days or only the days remaining after mail delays and processing gaps.

Request a demo to see how Chronicle handles deadline tracking for firms at your scale.